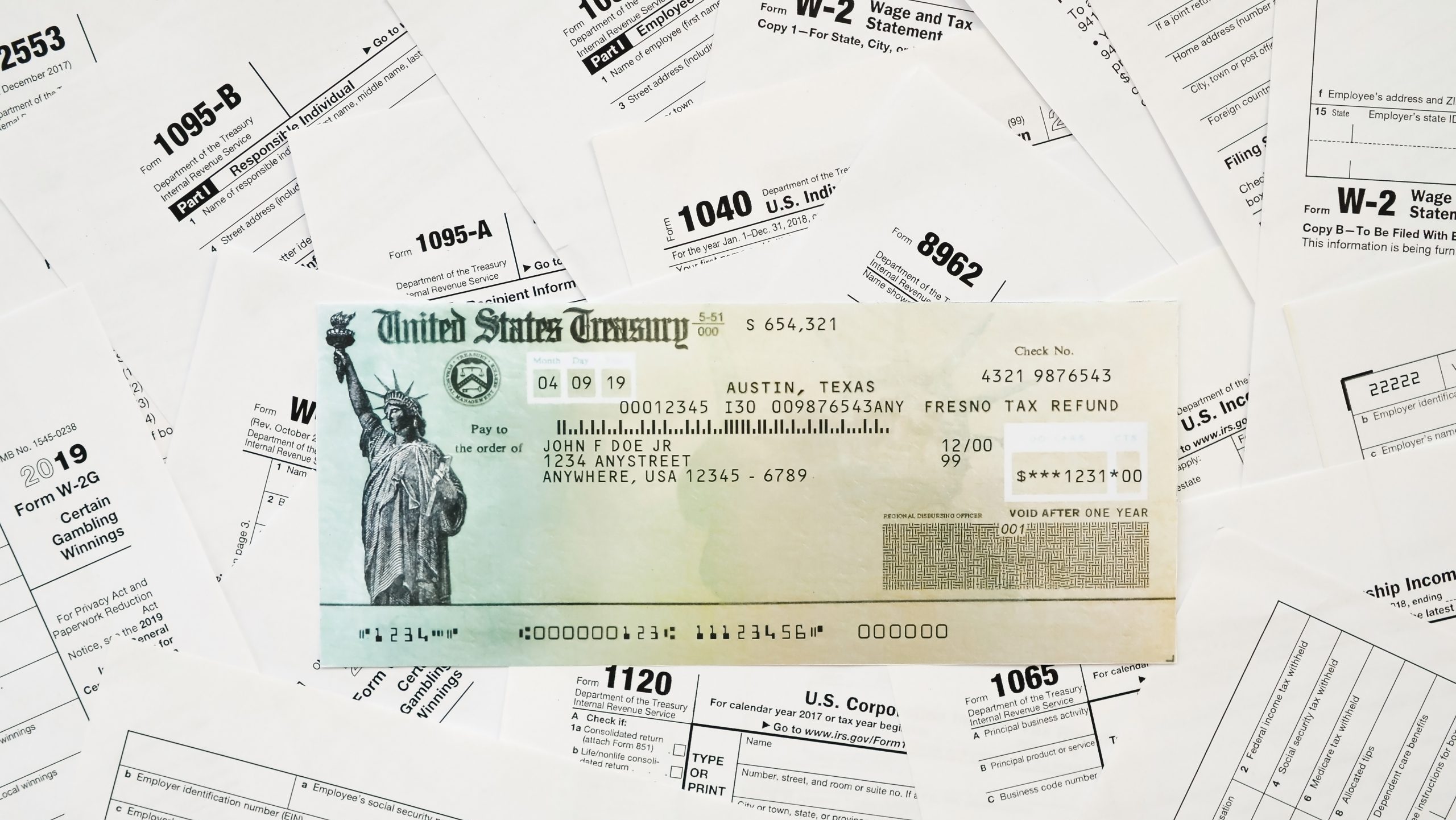

If you or someone you know hasn’t filed a 2021 tax return yet, there’s more than a billion dollars in potential refunds waiting to be claimed—but not for long.

The IRS recently announced that over 1.1 million taxpayers across the country may be entitled to refunds for the 2021 tax year. But here’s the catch: the deadline to file and claim that money is April 15, 2025. After that, unclaimed refunds legally become the property of the U.S. Treasury.

Why This Matters

According to the IRS, the median potential refund is $781. That means many could be leaving even more on the table, especially those eligible for the Earned Income Tax Credit (EITC)—worth up to $6,728 for 2021. This could be a big deal for low- to moderate-income workers or families who missed out on filing during a turbulent year.

Who Should Take Action

What You Can Do Now

If you think you or a client may qualify, don’t wait until the last minute. Filing a late return can take time—especially if you’re missing documentation. Here are some helpful steps to get started:

A Few Quick Facts

Final Thoughts

Time is ticking, and once the deadline passes, that money is gone for good. Whether you’re a taxpayer who missed the filing window or a business owner working with clients who may have overlooked it, there’s still time—but only if action is taken now.